© Source: Lori Butcher / Shutterstock.com DraftKings (DKNG) logo on a phone

Betting on the DraftKings Sportsbook is currently only available in certain states. To find out which states, check out our guide to where sports betting is legal. If you live in a state where online sports betting is not permitted, you can sign up via this link to receive updates on the status of legislation and ways you can help bring sports. Betting on the DraftKings Sportsbook is currently only available in certain states. To find out which states, check out our guide to where sports betting is legal. If you live in a state where online sports betting is not permitted, you can sign up via this link to receive updates on the status of legislation and ways you can help bring sports. 2 days ago Previously, the landmark marketing and content deal between DraftKings and the NFL was limited to the United States. The deal announced Thursday extends the arrangement into Canada.

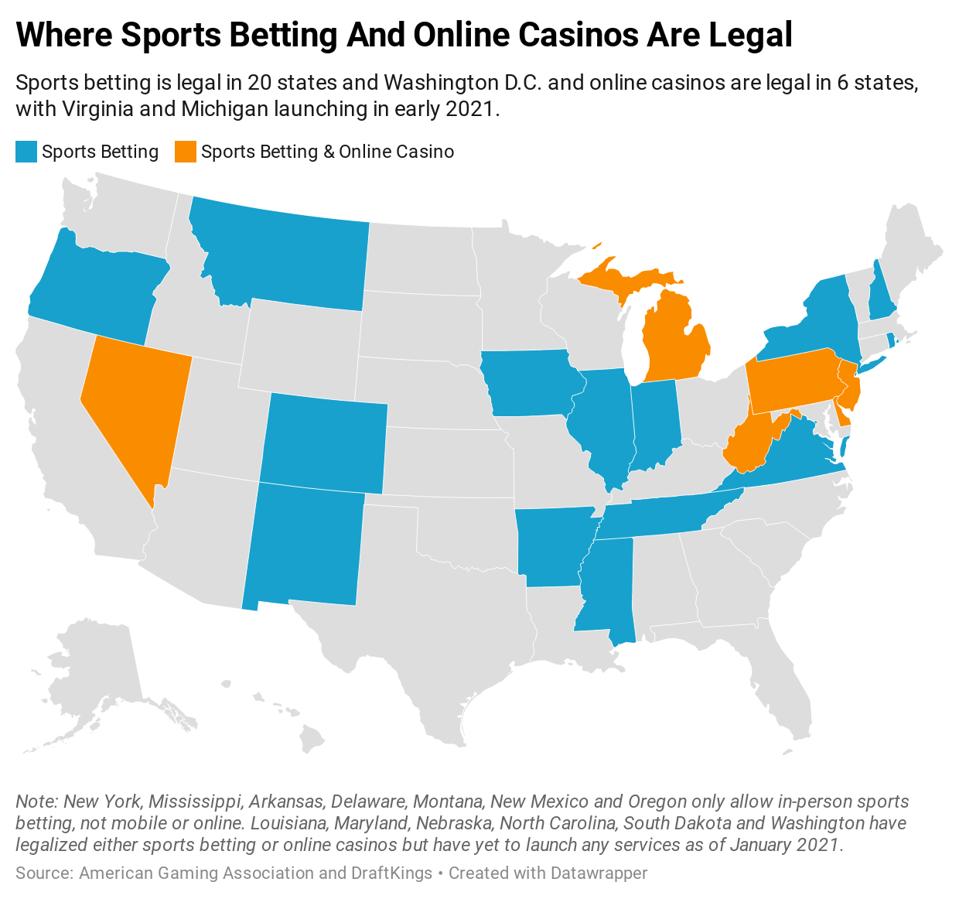

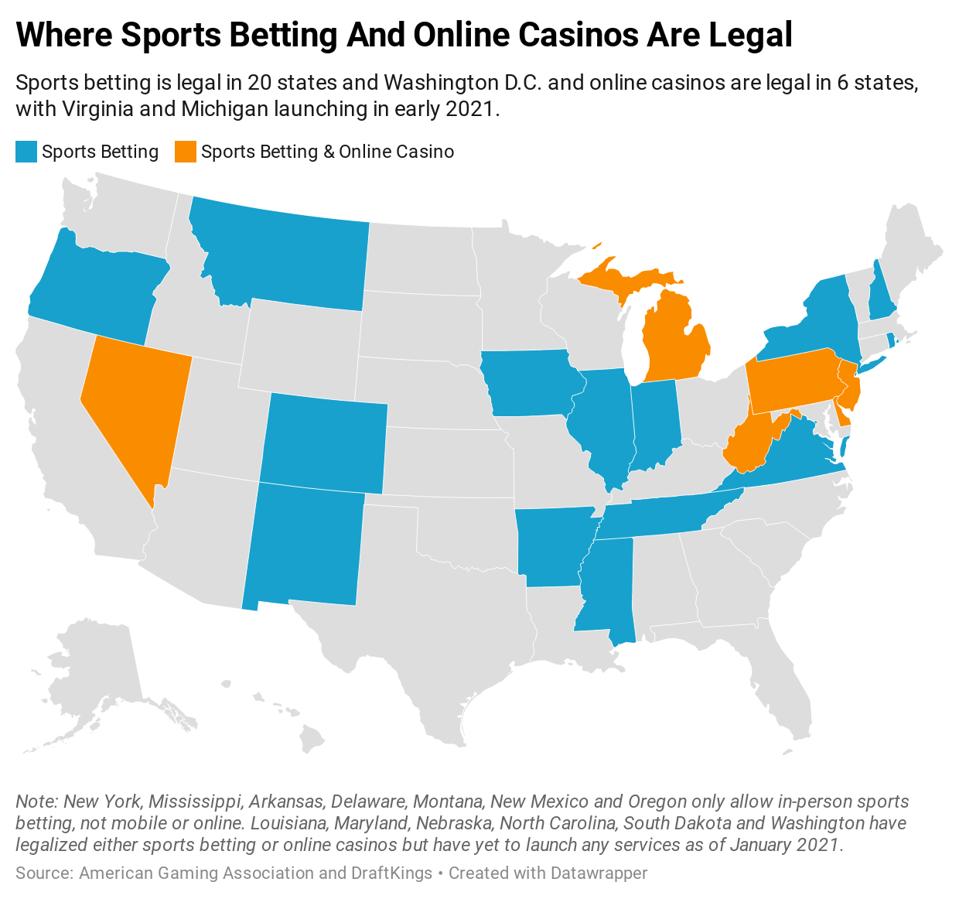

Since it debuted as a public company last April, a large part of the thesis around DraftKings (NASDAQ:DKNG) is that, as the lone pure-play sports betting equity, it’s a premier way to play increasing state-level legalization of sports wagering. Lately, DKNG stock is reflecting as much, jumping 11.50% for the week ending Jan. 13.

© Provided by InvestorPlace DraftKings (DKNG) logo on a phoneOn Wednesday, DKNG gained 2.32% to reach its highest levels in a month on reports that Michigan is likely to allow internet casinos and online sports betting.

It was known that the Wolverine State signed off on those activities, but the timeline is being accelerated to the benefit of gaming equities. Add to that, Virginia expects to have sports betting operational before the Super Bowl, though it remains to be seen if DraftKings will procure a license in the commonwealth.

Popular Searches

As I’ve previously noted, sports wagering ballot propositions went undefeated on Election Day, confirming that the industry has regulatory tailwinds; a scenario analysts expect will persist over the course of 2021 and beyond.

Still, estimates regarding the all-important total addressable market (TAM) for domestic sports betting vary wildly. Some forecasts call for a TMA of $15 billion to $20 billion at the low end, but Loop Capital analyst Daniel Adam calls for double that and is correspondingly bullish on DraftKings.

“To this end, we expect DKNG to emerge the clear share leader and biggest beneficiary of the rapidly growing domestic online gaming industry given its: (1) early/first mover advantage in most states; (2) powerful brand recognition; and (3) digital-first DNA,” said Adam.

Draftkings Blackjack States

Gambling Approvals and DKNG Stock

In the domestic sports betting universe, New Jersey is the big kahuna and DraftKings operates there. The company’s platform is also available in other large states with strong sports gambling cultures, such as Illinois and Pennsylvania, and fast-growing mid-sized markets, including Colorado and Indiana, among others.

That gets us to the big four of California, Florida, New York and Texas. In the interest of simplicity, there’s no chance regulated sports betting comes to life in California this year.

As for Florida, the situation there is complex. Some politicians there are pressing the issue, but the fate of sports betting in the Sunshine State lies with voters with some experts noting any legislative action on this front violats the state constitution.

Now, let’s talk New York. Sports betting is legal there, but it’s confined to upstate casinos that are nowhere near the major population mass of New York City. The Empire State currently doesn’t allow online sports wagering, but Gov. Andrew Cuomo recently changed his stance and is warming up to the idea. That explains much of the bullishness in DraftKings to start 2021.

Here’s where things get murky. While Cuomo is warm to the idea of mobile sports betting in New York, he wants the lottery to run it. That would shut out operators like DrafKings. At a recent press conference, Cuomo said the idea is for mobile betting to make money for the state, not for the state to make money for gaming companies.

It’s his right to feel that way, but the opinion is ill-founded. States that have lottery-only sports betting systems aren’t generating nearly the results that truly open markets are.

Lottery-sponsored sports betting is developing a reputation for offering lousy lines to gamblers – see Montana and Washington, D.C. – and in markets where there’s a competing product, such as the nation’s capital, gamblers inevitably bet with the private company, not the lottery.

In fact, the lottery-only sports betting system is so disastrous that Oregon is trying to scrap it and open the market to companies like DraftKings. Bottom line: New York may approve mobile sports betting, but there are no guarantees the move will benefit gaming companies.

The 2021 Wild Card

If I had to bet, pun intended, if New York goes the lottery-only route, DraftKings and its peers will be punished, at least on the trading day the news arrives.

Draftkings Illegal What States

But there’s another potential catalyst, though further out. There’s budding momentum for sports betting in Texas, the most conservative of the four largest states.

Reportedly, one of the ideas being pitched is that 14 of the 20 licenses the state could award would go to pro sports franchises and racetracks with those entities then partnering with sportsbook operators like DraftKings.

Assuming the state legalization catalyst is credible (it is), sheer numbers indicate Texas could be more meaningful for DKNG stock than Cuomo botching the issue in New York is negative for the shares.

Draftkings States Legal

After all, Texas has 10 million more residents. Translation: If political support for sports wagering in the Lone Star State grows over the course of 2021, investors will want to be involved with DraftKings.

Draftkings Restricted States

On the date of publication, Todd Shriber owns shares of DKGN.

Todd Shriber has been an InvestorPlace contributor since 2014.